Author: Michele Canteri ,GFT Italia

In today's digital age, Critical Infrastructure Protection (CIP) has become a cornerstone of security strategies, particularly within the financial sector. CIP refers to the safeguarding of essential systems and assets that are vital for the functioning of society, including banking systems, payment networks, and data management infrastructures. These infrastructures not only facilitate everyday transactions but also uphold public trust in financial institutions. However, as technology evolves, so do the threats against these systems. The convergence of cyberattacks and insider threats presents a formidable challenge, capable of disrupting services and eroding the trust that customers place in their financial institutions. The rising sophistication of cyber threats—often executed through coordinated attacks that exploit both external vulnerabilities and internal weaknesses—has underscored the urgent need for innovative and integrated security solutions. As financial institutions increasingly rely on interconnected cyber-physical systems, understanding and mitigating these dual threats is critical to ensuring operational resilience and protecting sensitive customer data.

Threat Landscape

Financial infrastructures are inherently vulnerable due to their interconnected nature. The integration of digital technologies into traditional banking systems creates a complex web where a single point of failure can lead to widespread disruption. Cyber-physical systems, which combine computational elements with physical processes, are particularly susceptible to both external cyberattacks and internal sabotage.

Amplified Risks

The dual threats posed by external cybercriminals and internal malicious actors can significantly amplify risks. External attackers may employ tactics such as phishing, malware, or ransomware to breach defenses, while insiders—current or former employees with privileged access—can exploit their knowledge to inflict harm or steal sensitive information. This combination not only increases the likelihood of successful breaches but also complicates detection efforts. For instance, an insider may manipulate system access logs to conceal their actions while executing a coordinated attack with external accomplices. The financial sector has seen notable incidents where insider threats have compounded the effects of external attacks. In 2015, a financial advisor at Morgan Stanley attempted to steal data on 350,000 clients, planning to sell this information. Although the breach was contained, it highlighted how insiders can facilitate or exacerbate security incidents that originate from outside the organization.

Insights from EU-CIP

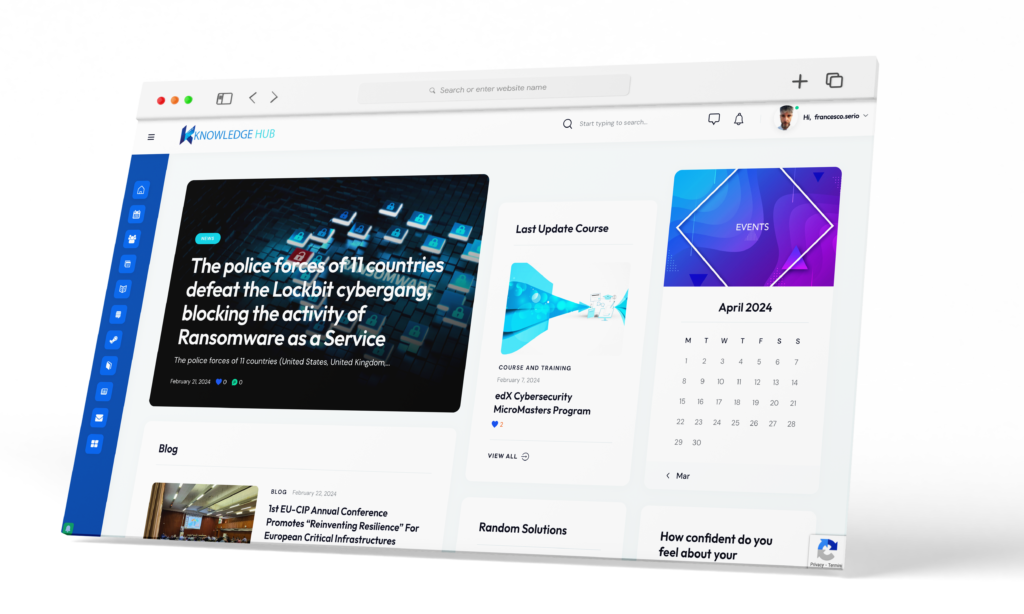

The EU-CIP (European Critical Infrastructure Protection) project plays a pivotal role in enhancing resilience against these evolving threats through knowledge sharing and cross-sector collaboration. By promoting best practices among various industries, EU-CIP fosters a proactive approach to cybersecurity that addresses both external and internal vulnerabilities.

Proactive Measures

EU-CIP encourages financial institutions to adopt a holistic view of security that encompasses all aspects of their operations—from physical security measures to cyber defense strategies. This includes regular training for employees on recognizing insider threats and implementing stringent access controls to limit exposure to sensitive data. By sharing insights across sectors, EU-CIP helps organizations stay ahead of emerging threats and develop comprehensive risk management frameworks.

Contribution of FINSEC

The FINSEC project (https://www.finsec-project.eu/) is a European initiative aimed at enhancing the security and resilience of financial infrastructures by addressing both cyber and physical threats. It developed a holistic security framework that integrates predictive capabilities, automated threat intelligence, and compliance with industry standards. A key outcome of FINSEC is the FINSTIX model, an extension of the Structured Threat Information eXpression (STIX) standard, which combines physical and digital threat intelligence for better risk management in the financial sector.

FINSEC (Financial Security) complements initiatives like EU-CIP by providing a structured approach to integrating cyber and physical threat intelligence within the financial sector. Through its holistic security blueprint and the FINSEC-FINSTIX data model, FINSEC enables organizations to analyse risks comprehensively.

Achievements and Innovations

FINSEC has made significant strides in validating security mechanisms through pilot projects that foster collaboration among stakeholders in the financial sector. These pilots test innovative solutions designed to enhance threat detection capabilities while ensuring compliance with regulatory standards. Moreover, FINSEC's predictive security capabilities allow organizations to anticipate potential threats based on historical data patterns and current trends. This proactive stance not only aids in regulatory compliance but also strengthens operational resilience by preparing institutions for various threat scenarios before they materialize.

Synergies Between EU-CIP and FINSEC

The collaboration between EU-CIP and FINSEC exemplifies how cross-sector learning can enhance resilience strategies within critical infrastructures. By leveraging FINSEC’s innovations, EU-CIP promotes interoperability among different sectors, allowing for shared insights into best practices for mitigating insider threats.

Strengthening the CIP Framework

This synergy enriches the broader CIP framework by adopting methodologies inspired by financial sector experiences. For instance, insights gained from FINSEC’s focus on integrating physical security measures with cybersecurity protocols can inform practices across other critical sectors such as energy or transportation. By fostering an environment where knowledge sharing is prioritized, both EU-CIP and FINSEC contribute significantly to building a more resilient infrastructure capable of withstanding sophisticated cyber threats.

Call to Action

As we navigate an increasingly interconnected world, it is essential for individuals, organizations, and governments to recognize the interdependent nature of modern infrastructures. Protecting critical systems requires collective action and collaboration across all levels of society.

Steps to Enhance Security Awareness

- For Individuals: Stay informed about cybersecurity best practices and be vigilant against social engineering tactics that could compromise personal or organizational information.

- For Organizations: Implement robust training programs focused on cybersecurity awareness for all employees while establishing clear protocols for reporting suspicious activities.

- For Governments: Support initiatives like EU-CIP and FINSEC by facilitating funding for research into innovative security solutions that address both cyberattacks and insider threats.

In conclusion, as cyberattacks continue to evolve in sophistication and scale, so too must our approaches to safeguarding critical infrastructures within the financial sector. By fostering collaboration between sectors and prioritizing integrated security solutions, we can build a resilient future capable of withstanding the challenges posed by both external adversaries and internal vulnerabilities.

Stay informed. Stay vigilant. Stay secure.